Worry? Not If You use Gold Prices The correct Way!

페이지 정보

작성자 Ann 작성일24-12-06 03:58 조회3회 댓글0건관련링크

본문

The high inflationary surroundings of the late 1960s sucked out the last bit of air from the gold customary. Read on to find out a perfect purchaser who will buy your gold paying you the maximum cash. Selling gold on-line will usually get you the most effective value, though you’ll have to send your gold items to the buyer for an appraisal (most will present a prepaid mailer) and wait 24-forty eight hours after appraisal to receive your payment. Since jewellery is commonly the most respected thing a person owns, it is one of the mostly pawned objects. As we’ve defined in more detail in our information to selling gold jewelry to a pawn shop, pawn outlets usually provide significantly decrease costs for jewelry than online patrons. The gold commonplace also stabilizes prices and foreign change rates. Over the long term, a declining dollar typically means rising gold prices. That implies that solely 5 to 10 p.c of work reported stolen is ever recovered. The 5 beaches of Normandy are given code names: Sword and Gold have been code names for the beaches attacked by the British Second Army.

The high inflationary surroundings of the late 1960s sucked out the last bit of air from the gold customary. Read on to find out a perfect purchaser who will buy your gold paying you the maximum cash. Selling gold on-line will usually get you the most effective value, though you’ll have to send your gold items to the buyer for an appraisal (most will present a prepaid mailer) and wait 24-forty eight hours after appraisal to receive your payment. Since jewellery is commonly the most respected thing a person owns, it is one of the mostly pawned objects. As we’ve defined in more detail in our information to selling gold jewelry to a pawn shop, pawn outlets usually provide significantly decrease costs for jewelry than online patrons. The gold commonplace also stabilizes prices and foreign change rates. Over the long term, a declining dollar typically means rising gold prices. That implies that solely 5 to 10 p.c of work reported stolen is ever recovered. The 5 beaches of Normandy are given code names: Sword and Gold have been code names for the beaches attacked by the British Second Army.

Five years in the past, talks of "Dollar Death" and imminent market collapse dominated YouTube, with pressing warnings to exit the inventory market and to empty your financial institution accounts and to hoard treasured metals that may tide you through the Apocalypse. Economists don't agree on a single rationalization for the catastrophe but have noted that its key causes include the inventory market crash of 1929 and protectionist commerce policies. By making a pool of gold reserves available, the market worth of gold could possibly be kept according to the official parity price. Today, the worth of gold is determined by the demand for the steel, and though it's now not used as a regular, it still serves an important perform. The correlation continues to be biased toward the inverse (negative on the correlation research) though, so as the greenback rises, gold usually declines. Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and secure-haven assets. In 1968, a Gold Pool, which included the U.S. 1933. In 1971, the U.S. In August 1971, Nixon severed the direct convertibility of U.S. From 1968 to 1971, solely central banks may commerce with the U.S.

Five years in the past, talks of "Dollar Death" and imminent market collapse dominated YouTube, with pressing warnings to exit the inventory market and to empty your financial institution accounts and to hoard treasured metals that may tide you through the Apocalypse. Economists don't agree on a single rationalization for the catastrophe but have noted that its key causes include the inventory market crash of 1929 and protectionist commerce policies. By making a pool of gold reserves available, the market worth of gold could possibly be kept according to the official parity price. Today, the worth of gold is determined by the demand for the steel, and though it's now not used as a regular, it still serves an important perform. The correlation continues to be biased toward the inverse (negative on the correlation research) though, so as the greenback rises, gold usually declines. Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and secure-haven assets. In 1968, a Gold Pool, which included the U.S. 1933. In 1971, the U.S. In August 1971, Nixon severed the direct convertibility of U.S. From 1968 to 1971, solely central banks may commerce with the U.S.

In August 1971, Britain requested to be paid in gold, forcing Nixon's hand and formally closing the gold window. Though a lesser form of the gold normal continued until 1971, its death had started centuries before with the introduction of paper money-a more versatile instrument for our advanced financial world. As central banks diversify their monetary reserves (away from the paper currencies they accumulate and into gold) the value of gold usually rises. The Gold Pool collapsed in 1968 as member nations had been reluctant to cooperate totally in sustaining the market price at the U.S. This alleviated the strain on member nations to understand their currencies to keep up their export-led growth strategies. The U.S. abandoned the gold commonplace in 1971 to curb inflation and stop foreign nations from overburdening the system by redeeming their dollars for gold. With a surplus turning to a deficit in 1959 and growing fears that international nations would begin redeeming their greenback-denominated belongings for gold, Senator John F. Kennedy declared, in the late phases of his presidential marketing campaign, that he would not try to devalue the dollar if elected.

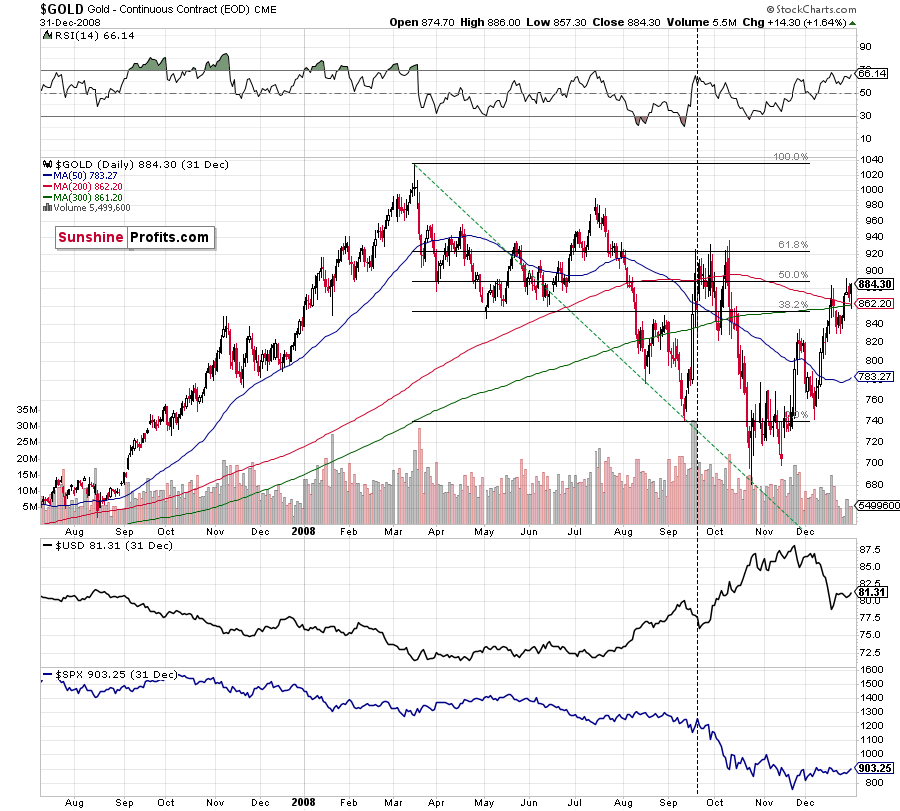

In the next years, each Belgium and the Netherlands cashed in dollars for gold, with Germany and France expressing related intentions. She was already a practicing dentist after which went again to obtain a Doctor of Medicine diploma (M.D.) from Tufts University in 1903. And she was deeply fascinated in the arts, therefore her excursion to France. In the figure under, discover the correlation indicator which strikes from a powerful unfavourable correlation to a positive correlation and back once more. It's also used by the banks as a way to hedge in opposition to loans made to their government and as an indicator of economic health. Gold is a significant monetary asset for international locations and central banks. Proponents of the gold standard argue that it prevents inflation, as governments and efactgroup.com banks are unable to control the money supply, comparable to by overissuing money. A return to the gold normal would restrict the Federal Reserve's ability to print cash and constrain its capacity to enact financial policy during vital financial occasions, comparable to recessions.

댓글목록

등록된 댓글이 없습니다.